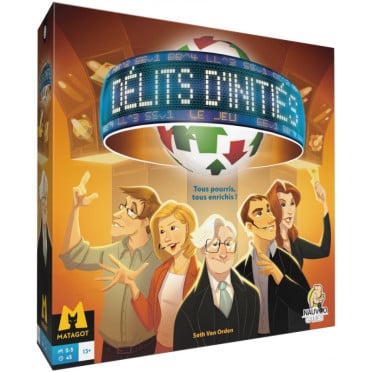

Délits d'Initiés

MATSTO001335

- French

- from 13 years

- 30mn to 1h

- 2 to 5 player(s)

All rotten, all rich!

In Délits d'Initiés, players take on the role of stock market investors at the end of the 20th century, hoping to become rich. The investor with the most money at the end of the game is the winner. Insider trading is based on the idea that nobody knows everything about the stock market, but everyone knows something. In the game, this philosophy manifests itself in two ways: insider information and reserve.

Ultimately, everyone knows something about the stock market, so it all comes down to strategy execution. Will you be able to navigate stock market movements with certainty? Or will your investments collapse due to poor forecasts?

First of all, players receive insider information every round. This information determines how a share's value will evolve at the end of the round. By learning privately whether a share will go up or down, each player has a chance to act ahead of the market by buying or selling at the right time.

Secondly, players buy their shares by bidding on piles of cards called stocks. These piles contain a mixture of face-up and face-down cards placed by other players. In this way, nobody knows all the cards in the stock piles. Not all cards are good, either. Transaction fees can poison stacks by forcing players to pay more than they've offered. By auctioning stocks and other cards, Insider Trading catalyzes interaction between players, especially when potential profits from inside information are at stake.

These two mechanisms are combined with stock market elements to encourage players to consider multiple factors when selling a share.

Are you holding on to your shares in the hope of profiting from a lucrative split, or are you selling now to avoid the company's potential bankruptcy?

Can you hold on to your shares until the end of the game to become the majority shareholder, or do you need cash now to make future bids?

Do you risk everything by investing heavily in a single company, or do you mitigate risk by diversifying your portfolio?

Copyright © 2025 www.philibertnet.com Legals - Privacy Policy - Cookie Preferences - Sitemap